Blockchain Technology in Supply Chain Management and Finance is a decentralised digital ledger that securely and openly logs transactions across numerous computers. It was originally developed as the underlying technology for the cryptocurrency Bitcoin but has since been adapted for a wide range of use cases beyond just digital currencies.

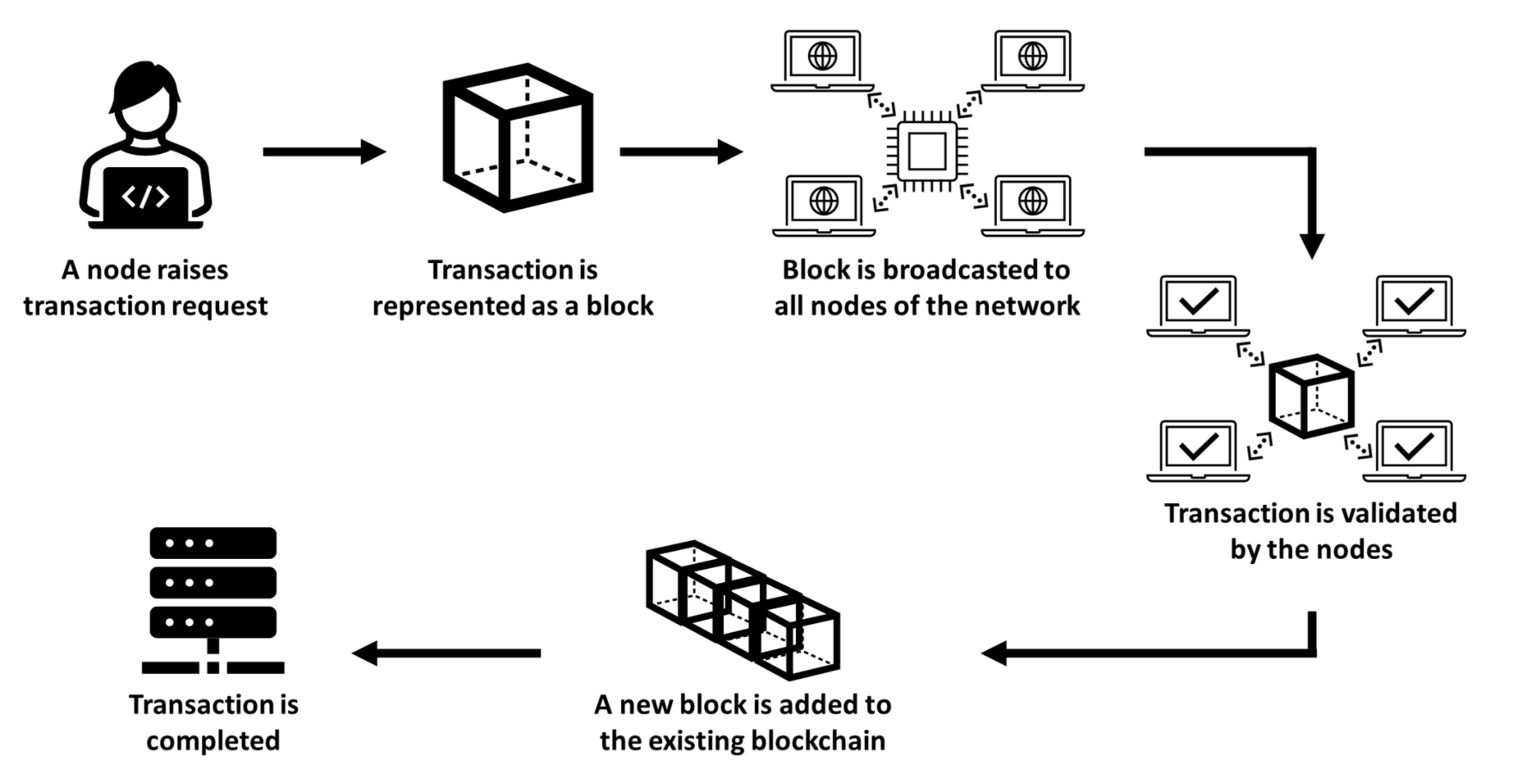

A blockchain is made up of blocks of data, where each block contains a record of multiple transactions. Once a block is filled with transactions, it is added to the chain of blocks (hence the name “blockchain”) in a linear, chronological order. This chain is maintained by a network of computers, which use complex algorithms to verify and validate the transactions in the block. Once a block has been validated and added to the blockchain, the information it contains is considered to be permanent and cannot be altered.

The decentralisation of the blockchain is one of its key features. Unlike traditional ledger systems, which are maintained by a central authority, blockchains are maintained by a network of computers that are spread out across the internet. This makes them much less vulnerable to manipulation or failure, as there is no single point of control or failure.

All parties on the network can see the transactions in the blockchain, which increases the level of trust and security in the system. At the same time, the use of cryptography ensures that the identities of the parties involved in a transaction are kept confidential.

Blockchain technology has a wide range of potential applications, from financial services and supply chain management to digital identity and voting systems. In the financial industry, blockchain can be used to securely and transparently record financial transactions, such as the transfer of money or the trading of assets. In supply chain management, blockchain can be used to track the movement of goods and ensure that all parties in the supply chain have accurate and up-to-date information.

Uses of Blockchain Technology in Finance

Many businesses, including financial, stand to benefit from blockchain technology. The decentralised nature of blockchain, along with its security and transparency, make it ideal for use in financial applications. Here are some of the ways blockchain technology is being used in finance:

- Cryptocurrencies: The most well-known use of blockchain technology is the creation of cryptocurrencies like Bitcoin, Ethereal, and Litecoin. These digital assets are secured and managed using a decentralised network of computers, making them secure and transparent.

- Payments and Transfers: Blockchain technology can be used to speed up and streamline the payment and transfer process, reducing the need for intermediaries and increasing the security of transactions. This has the potential to make cross-border payments faster and more efficient.

- Supply Chain Finance: Blockchain technology can be used to track the movement of goods and services (goods and services tax), providing greater visibility and security to supply chain finance. This can help reduce the risk of fraud and ensure that all parties are paid on time.

- Securities and Commodities Trading: Blockchain technology has the potential to increase the efficiency and transparency of securities and commodities trading, helping to reduce the risk of fraud and streamlining the settlement process.

- Digital Identity: Blockchain technology can be used to create a secure and decentralised digital identity system, helping to increase security and reduce the risk of identity theft.

Supply Chain Management

Blockchain technology has the potential to transform supply chain management in the finance industry by providing increased transparency, security, and efficiency to the supply chain process. Here are some of the ways blockchain is being used in finance and supply chain management:

Traceability: Blockchain technology can be used to track the movement of goods and services in any country (goods and services tax India) providing a complete and immutable record of all transactions. This can help improve the transparency of the supply chain and reduce the risk of fraud.

Smart Contracts: Blockchain technology can be used to create self-executing smart contracts, which automate the process of managing contracts and payments in the supply chain. This can help reduce the risk of fraud and ensure that all parties are paid on time.

Payment Processing: Blockchain technology can be used to speed up and streamline payment processing, reducing the need for intermediaries and increasing the security of transactions. This can help reduce the risk of fraud and ensure that all parties are paid on time.

Asset Management: Blockchain technology can be used to securely manage and track assets, such as commodities and securities, providing a secure and transparent record of ownership.

Compliance: Blockchain technology can be used to ensure that all parties in the supply chain comply with regulations and standards, reducing the risk of fraud and ensuring that all parties are acting ethically and responsibly.

In conclusion, the use of blockchain technology in finance services around the world like income tax filing online, GST registration, FSSAI registration, tax filing in India, and LLP registration in India and supply chain management has the potential to provide greater transparency, security, and efficiency to the supply chain process, helping to reduce the risk of fraud and improving the overall functioning of the industry.